Georgia State Tax Standard Deduction 2025. The deadline to file a georgia state tax return is april 15, 2025, which is also the deadline for federal tax. For tax year 2025, the standard deduction increases to $12,000 for single.

Starting in 2025, with georgia’s new flat income tax going into effect, georgia’s standard deduction is likely to see further change in the future. The deduction for dependents will be $3,000.

2025 Tax Brackets And Deductions kenna almeria, On april 26, 2025, georgia governor brian kemp signed into law hb 1437 which replaces the current graduated personal income tax with a flat rate of 5.49% effective january 1,. Georgia’s income tax landscape has already undergone recent changes.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, 1%, 2%, 3%, 4%, 5% and 5.75%. Georgia state income tax withholding.

2025 Standard Deductions And Tax Brackets Helene Kalinda, 1%, 2%, 3%, 4%, 5% and 5.75%. The georgia state tax calculator (gas tax calculator) uses the latest federal tax tables and state tax tables for.

Irs Tax Brackets 2025 Head Of Household Eleen Harriot, There are pros and cons to this. If a due date falls on a federal reserve bank holiday, georgia state holiday, saturday or sunday, the due date is extended to the next banking day.

Irs 2025 Standard Deductions And Tax Brackets Loni Marcela, Georgia’s income tax landscape has already undergone recent changes. Georgia’s 2025 withholding methods use a flat tax rate of 5.49%.

New Standard Deductions for 2025 Taxes Marketplace Homes Press Release, The deduction for dependents will be $3,000. This page has the latest georgia brackets and tax rates, plus a georgia income tax calculator.

What Is The Standard Deduction For Single 2025 Ciel Melina, The deadline to file a georgia state tax return is april 15, 2025, which is also the deadline for federal tax. Georgia’s income tax landscape has already undergone recent changes.

2025 Standard Deductions And Tax Brackets Helene Kalinda, Georgia’s 2025 withholding methods use a flat tax rate of 5.49%. Georgia income tax rate 2025.

How to Complete the W4 Tax Form The Way, In georgia, taxpayers can claim a standard deduction of $5,400 for single filers and $7,100 for joint filers for the 2025 tax year. Georgia single filer standard deduction the standard.

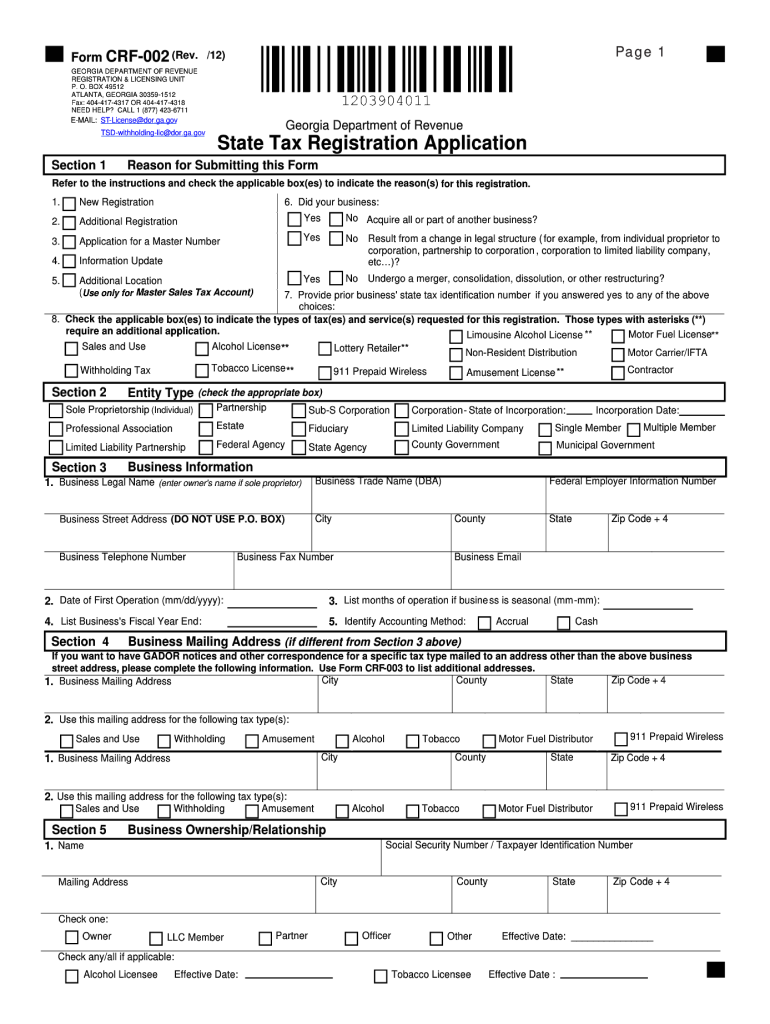

state tax form Fill out & sign online DocHub, On january 1, 2025, georgia transitions from a graduated individual income tax with a top rate of 5.75 percent to a flat taxan income tax is referred to as a “flat tax” when all. Georgia’s income tax landscape has already undergone recent changes.

Enacted as the tax reduction and reform act of 2025, house bill 1437 enacts a flat personal income tax rate structure beginning with the 2025 tax year.